Recruits please join the ranks: a real and vivid "growth diary" of recruits

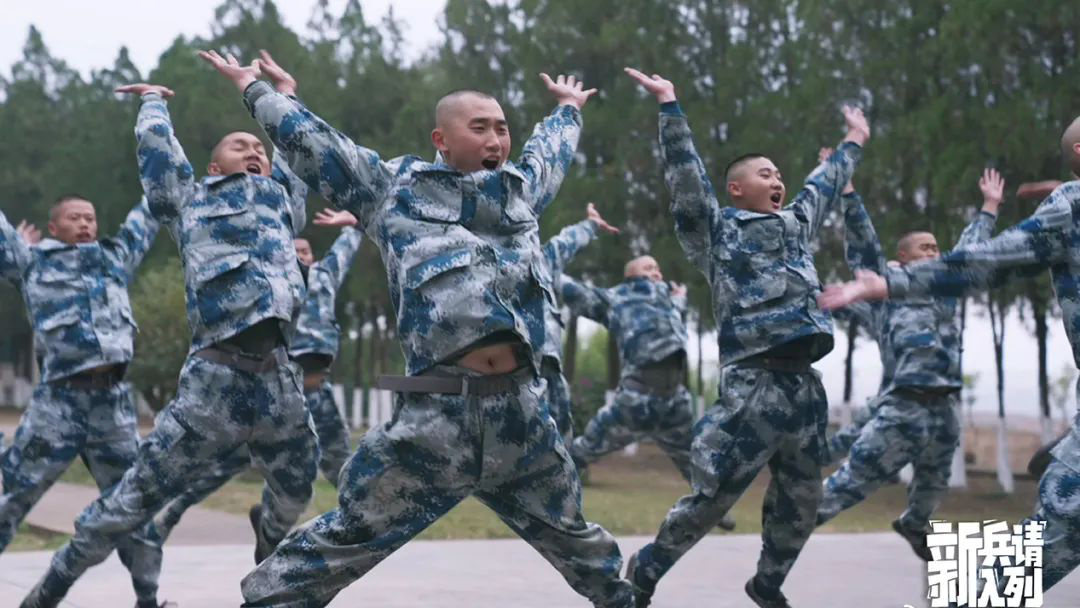

How does a recruit grow into a qualified soldier in 180 days and nights? "Recruits please join the ranks" goes deep into the record and observation of the recruit training base, and is serious and lively, showing the process of quenching the recruits into steel after 00.

Author: Zheng Changhua

How many steps does it take from ordinary people to soldiers? Establish rules, organize internal affairs, conduct actual combat training, and conduct rigorous assessment … Recently, the military documentary "Recruits Please Join the ranks" jointly produced by Tencent Video and CCTV was broadcast online, and the whole process of the recruits growing into qualified soldiers was recorded by lens.

The program consists of seven periods, each with a theme. Starting with "Why did I choose to be a soldier", it has gone through 180 days and nights, spanning 20,000 kilometers, and went deep into the recruit training base of the three armed forces, telling the stories of recruits and military camps with short stories and true details.

Youth stories of recruits after 00

The recruits come from all over the world, with different life experiences and different temperaments, but they all come to the same place-the military camp with their love for the motherland.

Xu Menghao, high flyers, Department of Philosophy, Peking University, likes reading and Henan Opera; Duan Runzhi, an undergraduate student, is lively and excellent in learning, and is what people call "the child of others"; Lin Junlong, born by the sea, used to be a chef in a five-star hotel; Cai Zhuoyu, a fine arts major, hopes to paint in the blue sky with fighter planes after entering the military camp … Such a group of young people constitute the epitome of the whole film’s recruit camp.

"Recruits please join the ranks" aims the camera at these recruits after 00 and records the process of their tempering into steel. This tempering process is naturally full of hardships and challenges.

"It’s too difficult to turn a quilt into a tofu block!" Duan Runzhi, an army female soldier, never thought that she would "cushion the bottom" in a late-night emergency pull. The instructor’s minimum requirements became her "ceiling". The first packing was completely out of specification, and the second packing was successful, but she was criticized by the instructor for being too slow.

The air force brigade will fuck, and Class 9 will win the championship in one fell swoop. The joy of "counterattack" didn’t last long, and the pull-up project suddenly turned Cai Zhuoyu and Lin Junlong back to the prototype of "rookie". Physical fitness test, their scores hit a new record low, waiting for them is the "devil" training customized by the squad leader for them.

"It’s very real" and "It’s so good to cry" … Since the broadcast of "Recruits Please Join the Team", it has gained a lot of attention among young audiences. The protagonists of these stories do not have their own aura, but ordinary young people. Putting them in a special living environment, their stories naturally collide with the audience.

The film focuses on interacting with young netizens and strengthening dialogue with the audience in a full-fledged presentation. On the one hand, it is a humorous panoramic record of the recruits’ state. The rotation is left and right, the singing of military songs is out of tune, and the squad leader directs his comrades to "hit the tree" … A series of "god operations" with their own jokes make the work more grounded; On the one hand, Wang Bingbing, a reporter from the General Station, is the narrator, and the relaxed and humorous comment language such as "Mother learns to bully", "paddling to fish", "being rubbed by reality" and "Voldemort" not only adds a sense of delicacy to the film, but also adds youthful expression.

The growth story from youth to soldiers

Director Zhao Yunze said: "Before officially contacting this project, it is hard to imagine how the army trained ordinary people into soldiers in batches in just six months."

The director’s curiosity is also the breakthrough of the film.

Before joining the army, the recruits’ imagination of the military camp was intense and grand; After joining the army, their reality in the new barracks is to stand at attention at ease and have a little routine. "Recruits Please Join the Rank" concentrates the six-month time that these recruits entered the military camp after 00 in chronological order, and records their growth stories in the "conflict" and dynamics.

The title of "Peking University" did not give Xu Menghao more superiority. He was appointed as the monitor of the new recruits, and one of his duties was to upload and issue. It seems simple, but it is challenging: this requires him to have both excellent basic skills and high emotional intelligence, otherwise it will be difficult to convince the public.

In the updated program, Xu Menghao hit a wall when he first exercised his monitor’s rights. "Everyone is a recruit. Why do you command everyone to work?" Some comrades-in-arms disagreed with the way he assigned work and complained. With the help of veterans, Xu Menghao gradually realized that there was a big problem in his way of doing things. In the latest "picnic", he took the initiative to integrate into group activities and finally realized the "breaking the ice" with his comrades.

The program focuses on the intuitive response of recruits to setbacks, and outlines a "deformation meter" belonging to recruits in the low valley-contradiction-growth. Under the lens of the program, every recruit’s body and soul are being "scattered" and "reshaped" again. In the process of recording, in addition to the principle of non-intervention, the program also used another method-giving the microphone to the recruits.

At the end of the first program, the recruits can finally contact their families. Some people burst into tears at the sound of their family members, some people cried because they missed their mother and asked her to take more photos and send them to them, and some people told their families to have a good meal … A homesick greeting instantly "returned" the recruits to their prototype. At this moment, homesickness spread among them, without concealment or restraint, and all feelings broke through the screen. Iron soldiers are accompanied by deep affection, and the program outlines the true appearance of teenagers in real records.

As a co-producer, Tencent Video continues to connect with the audience in a young voice and novel expression. From How to Talk about this painting to The Great Qin of the Fresh Museum, and this time, the new recruits are invited to join the ranks. The themes are different, but they are all constantly "new" in expression. This time, "Recruits please join the ranks" aims at the recruits, which is a new exploration of the young expression of military themes. In the follow-up program, what are the unknown training programs for the sailors of the "One Speciality and Many Capabilities" warship, how to train the female soldiers of the "Snow Lotus on the Plateau" garrison in Tibet, and how the airmen of the "Blue Angel" air force guard Hawk to complete the battle will all be shown one by one.

Editor | Sui Fangfang Ning Yahong