From now on, the interest rate of provident fund loans will be reduced, and many officials across the country will announce it! The latest voice of the Ministry of Housing and Urban-Rural Development

Respond positively in many places!

The People’s Bank of China has decided to reduce the interest rate of individual housing provident fund loans by 0.25 percentage point from May 18, 2024, and adjust the interest rates of the first set of individual housing provident fund loans for less than five years (including five years) and more than five years to 2.35% and 2.85% respectively, and the interest rates of the second set of individual housing provident fund loans for less than five years (including five years) and more than five years to not less than 2.775% and 3.325% respectively.

The Securities Times reporter found that after the central bank’s policy was released, housing provident fund centers in Beijing, Shanghai, Shenzhen, Guangzhou, Dongguan, Zhongshan, Jiangmen, Shantou, Suzhou, Hefei, Nanjing, Chengdu, Chongqing, Changsha, Zhengzhou and Hubei responded positively and lowered the interest rate of provident fund loans.

How much can lenders save after the interest rate is lowered this time? Take the first personal housing loan of housing provident fund with a term of 30 years as an example. If the repayment method of principal and interest is equal, the monthly payment will be reduced from 4,270.16 yuan to 41,355.57 yuan, a decrease of about 135 yuan, and the total interest expense will be reduced by 48,500 yuan.

The relevant person in charge of the Housing Provident Fund Supervision Department of the Ministry of Housing and Urban-Rural Development said that the most direct beneficiary is the housing provident fund lender. The Ministry of Housing and Urban-Rural Development will guide the urban housing provident fund management center to do a good job of policy convergence in accordance with regulations to ensure that depositors can enjoy preferential policies at the first time.

Guangdong lowered the interest rate of provident fund loans in many places.

On May 18th, Shenzhen Housing Provident Fund Management Center issued a document saying that the loan interest rate of Shenzhen housing provident fund was lowered. Article 23 of the Regulations on the Administration of Housing Provident Fund Loans in Shenzhen stipulates that after the issuance of provident fund loans, if the national provident fund loan interest rate is adjusted, the provident fund center shall adjust the loan interest rate quarterly. For individual housing provident fund loans issued in Shenzhen before May 18, 2024, the adjusted interest rate will be implemented from July 1, 2024. Personal housing provident fund loans that were applied for before May 18, 2024 but not issued, and personal housing provident fund loans that were applied for after May 18, 2024 (inclusive) shall be subject to the adjusted interest rate.

Guangzhou Housing Provident Fund Management Center announced on May 17 that since May 18, 2024, the interest rate of individual housing provident fund loans will be lowered by 0.25 percentage point, and the interest rates of the first set of individual housing provident fund loans for less than five years (including five years) and more than five years will be adjusted to 2.35% and 2.85% respectively, and the interest rates of the second set of individual housing provident fund loans for less than five years (including five years) and more than five years will be adjusted to not less than 2.775% and 3 respectively. For personal housing provident fund loans issued from May 18, 2024, the new interest rate will be implemented; For individual housing provident fund loans issued before May 18, 2024, the new interest rate will be implemented from January 1, 2025 according to the loan contract.

The Dongguan Housing Provident Fund Management Center also issued a notice on May 17, 2024, and individual housing provident fund loans issued after May 18 (inclusive) will be implemented at the adjusted new interest rate. The outstanding individual housing provident fund loans issued before May 18, 2024 will be implemented at the adjusted new interest rate from January 1, 2025.

Jiangmen City issued a notice. According to the Notice of the People’s Bank of China on Lowering the Interest Rate of Individual Housing Provident Fund Loans on May 17, 2024, the interest rate of individual housing provident fund loans in Jiangmen City will be adjusted as follows from May 18, 2024:

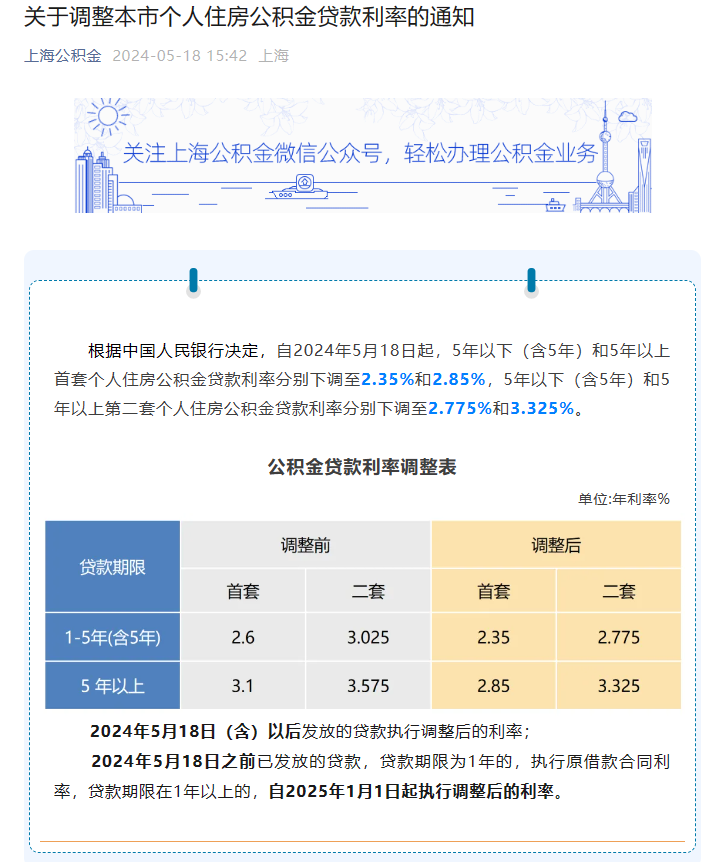

Interest rate of the first individual housing provident fund loan. For less than 5 years (including 5 years), it will be reduced from 2.6% to 2.35%, and for more than 5 years, it will be reduced from 3.1% to 2.85%.

The second set of personal housing provident fund loan interest rate. For less than 5 years (including 5 years), it will be reduced from 3.025% to 2.775%, and for more than 5 years, it will be reduced from 3.575% to 3.325%.

For individual housing provident fund loans issued before May 18, 2024, the new loan interest rate will be implemented from January 1, 2025.

Shantou Housing Provident Fund Management Center issued a notice on lowering the interest rate of individual housing provident fund loans, which proposed that individual housing provident fund loans issued after May 18, 2024 (including housing provident fund loans accepted but not released before May 18, 2024) should be implemented at a new interest rate of 2.35% for the first suite according to the interest rate of less than 5 years (including 5 years) and 2.85% for the interest rate of more than 5 years; The second suite is subject to the new interest rate of 2.775% for less than 5 years (including 5 years) and 3.325% for more than 5 years. For individual housing provident fund loans (including provident fund loans in discount loans) that have been lent before May 18, 2024, the new interest rate will be implemented from January 1, 2025.

According to the news released by Zhongshan, the adjusted interest rate will be implemented from January 1, 2025 for individual housing provident fund loans that have been issued before May 18, 2024. For individual housing provident fund loans that were applied for before May 18, 2024 but not issued, the adjusted interest rate of individual housing provident fund loans shall be implemented. Personal housing provident fund loans applied after May 18, 2024 shall be implemented according to the adjusted interest rate.

Beijing, Shanghai and other places are also lowered.

On May 18th, WeChat official account, the Shanghai Provident Fund, issued a notice on adjusting the loan interest rate of individual housing provident fund in this city. According to the decision of the People’s Bank of China, starting from May 18th, 2024, the loan interest rates of the first set of individual housing provident fund for less than five years (including five years) and more than five years were lowered to 2.35% and 2.85% respectively, and the loan interest rates of the second set of individual housing provident fund for less than five years (including five years) and more than five years were lowered to 2.775% and 2% respectively. The adjusted interest rate for loans issued after May 18, 2024 (inclusive); For loans issued before May 18, 2024, if the loan term is one year, the original loan contract interest rate will be implemented, and if the loan term is more than one year, the adjusted interest rate will be implemented from January 1, 2025.

According to Hubei Housing Construction News, as of this morning, 17 cities and states in Hubei have all lowered the interest rate of individual housing provident fund loans. For individual housing provident fund loans that have been issued before May 18, 2024, the original interest rate standard for individual housing provident fund loans will still be implemented, and the adjusted interest rate standard for individual housing provident fund loans will be implemented from January 1, 2025. For individual housing provident fund loans that have been accepted before May 18, 2024, the adjusted interest rate standard for individual housing provident fund loans will be implemented. For individual housing provident fund loans accepted after May 18, 2024 (inclusive), the adjusted interest rate standard for individual housing provident fund loans shall be implemented.

According to the news of the Central Broadcasting Network, the reporter called the Beijing Housing Provident Fund Management Center. The staff said that at present, Beijing has implemented a loan interest rate reduction. The staff further explained that the original personal housing provident fund loan interest rate standard is still implemented for personal housing provident fund loans that have been issued before May 18, 2024, and the adjusted personal housing provident fund loan interest rate standard will be implemented from January 1, 2025. For individual housing provident fund loans accepted before May 18, 2024 and accepted after May 18, 2024 (inclusive), the adjusted interest rate standard for individual housing provident fund loans shall be implemented. In addition, the staff of Beijing Housing Provident Fund Management Center introduced that the lender does not need to apply separately, and the loan interest rate will be automatically lowered. If the lender does not change the monthly repayment amount, it will be automatically calculated as overpaying the principal and underpaying the interest.

In addition, Suzhou, Hefei, Nanjing, Chengdu, Chongqing, Changsha, Taiyuan, Zhengzhou, Kunming, Jiangxi, Hainan and other places also issued notices that personal housing provident fund loans issued after May 18, 2024 (inclusive) will be implemented at the new interest rate. The unexpired individual housing provident fund loans issued before May 18, 2024 shall be implemented at the new interest rate from January 1, 2025.

However, there are also some places with different details, such as Suzhou, Nanjing and Taiyuan. For individual housing provident fund loans that were applied before May 18, 2024 but not issued, the adjusted interest rate of individual housing provident fund loans was implemented. Chengdu is a housing provident fund loan issued before May 18, 2024: if the loan term is more than one year, the loan interest rate will be adjusted on January 1, 2025; If the loan term is one year, the loan interest rate will not be adjusted.

How much money can you save by lowering interest rates?

According to china construction news news, the relevant person in charge of the Housing Provident Fund Supervision Department of the Ministry of Housing and Urban-Rural Development said in an interview that the housing provident fund has long provided low-interest housing loans to low-and middle-income groups to meet the housing needs of residents, which has been welcomed and concerned by the masses. Since the 18th National Congress of the Communist Party of China, the Ministry of Housing and Urban-Rural Development has implemented the decision-making arrangements of the CPC Central Committee and the State Council, actively played the role of housing provident fund, and solved the housing problem of depositors. Since 2012, a total of 12.9 trillion yuan of housing provident fund personal housing loans have been issued, and the loan balance has increased from 2.7 trillion yuan to 7.8 trillion yuan in 2023, supporting nearly 50 million depositors to live and live, of which more than 80% are buying the first home. In recent years, individual housing loans of housing provident fund have maintained steady growth year after year. In 2023, the loan balance increased by nearly 7%, and new loans increased by more than 24% year-on-year, which strongly supported the housing consumption of depositors.

In order to increase the support for depositors’ loans, in accordance with the relevant arrangements of the State Council, the Ministry of Housing and Urban-Rural Development actively studied and considered lowering the interest rate of individual housing loans for housing provident funds as a package of work to promote the stable and healthy development of the real estate market, and jointly promoted the implementation of policies with the People’s Bank of China. In order to put the policy in place, on May 17th, the Ministry of Housing and Urban-Rural Development issued the Notice on Doing a Good Job in Lowering the Interest Rate of Individual Housing Loans for Housing Provident Funds, guiding the local housing provident fund management agencies to implement it well, so as to effectively let the depositors enjoy this policy of benefiting the people.

The above-mentioned person in charge pointed out that the most direct benefit from the reduction of the loan interest rate is the housing provident fund lender. Take the first personal housing loan of housing provident fund with a term of 30 years as an example. If the repayment method of principal and interest is equal, the monthly payment will be reduced from 4,270.16 yuan to 41,355.57 yuan, a decrease of about 135 yuan, and the total interest expense will be reduced by 48,500 yuan. The benefits that buyers get are real.

The person in charge also said that the Ministry of Housing and Urban-Rural Development will guide the urban housing provident fund management center to do a good job of policy convergence in accordance with regulations to ensure that depositors can enjoy preferential policies in the first time.

Adjust the provident fund loan policy in many places

In addition, Shaanxi, Hangzhou and Hefei have also adjusted their provident fund loan policies.

On May 17th, Shaanxi Provincial Housing Fund Management Center issued the Notice on Adjusting the Relevant Policies of Housing Provident Fund Loans. According to the notice, if you use provident fund loans to buy a house for the first time, the down payment ratio is not less than 20%; After the first provident fund loan is settled, if you use the provident fund loan to buy a house again, the down payment ratio shall not be less than 25%. If you use provident fund loans to buy second-hand housing, the housing completion period shall not exceed 30 years, and the sum of the loan period and the housing completion period shall not exceed 40 years, and the longest loan period shall be 30 years. If families with two or more children use provident fund loans to buy houses, the maximum loan amount will be increased to 1.2 times on the basis of the current policy.

On May 17, Hangzhou Housing Provident Fund Management Committee issued a notice on the relevant policies to adjust the criteria for determining the number of housing units for families with housing provident fund loans. According to the notice, the number of family housing units shall be subject to the inquiry results or certification issued by the real estate management department where the house is purchased. Housing provident fund loans for the first and second suites are determined according to the number of family housing units and housing provident fund loans. Housing provident fund loans are subject to the query results of the housing provident fund supervision service platform of the Ministry of Housing and Urban-Rural Development. The down payment ratio policy for housing provident fund loans remains unchanged. The notice shall come into force on May 15, 2024. If the online signing date of the contract is on or after May 9, 2024, it shall be implemented in accordance with the provisions of this notice. The signing date of the online signing sales contract for new commercial housing shall prevail, and the signing date of the online signing transfer contract for second-hand housing shall prevail. If the contract has been signed before May 9, 2024, it shall be implemented according to the original credit policy.

On May 17th, the Office of Hefei Housing Provident Fund Management Committee issued the Notice on Adjusting the Maximum Loanable Amount of Individual Housing Provident Fund in our city. According to the notice, if the borrower’s family and husband and wife have paid the housing provident fund normally for six months, the maximum loan amount will be raised from 550,000 yuan and 650,000 yuan to 1 million yuan; If the borrower unilaterally pays the housing provident fund for 6 months, the maximum loan amount will be raised from 450,000 yuan and 550,000 yuan to 700,000 yuan. Families with many children who meet the policy purchase the first set of housing, and if the husband and wife normally pay the housing provident fund according to the regulations, the maximum loan amount will be raised from 750,000 yuan to 1.2 million yuan; If the housing provident fund is paid unilaterally according to the regulations, the maximum loan amount will be raised from 650,000 yuan to 840,000 yuan.

Proofreading: Wang Jincheng